Choosing the right financial institution is a critical step for any entrepreneur. The best banks for small business offer more than just a place to hold your money; they provide tools to manage cash flow, opportunities for business credit, and streamlined online banking services that save you time. For deeper insights into choosing the perfect business account, you can explore detailed reviews and comparisons in this comprehensive guide to the best business Checking Accounts for 2025, which breaks down the features, fees, and benefits of top providers.

Whether you’re a startup looking for a no-fee business checking account or an established company needing robust merchant services and small business loans, the right business bank can be a powerful partner in your growth. This guide explores the top small business banking options for 2025, helping you find the perfect business account for your unique needs.

Metrobi drivers are rated 4.97/5

Trusted by local businesses for:

- Background-checked professionals

- Specialized in business deliveries

- Same drivers for consistency

- 4.97/5 average delivery rating

1. Chase Business Complete Banking

Best for Businesses Needing Nationwide Branch Access and Integrated Services

Pros | Cons |

|---|---|

✔️ Extensive branch and ATM network for convenient in-person banking. | ❌ A non-waivable monthly fee applies if balance requirements aren’t met. |

✔️ A full suite of products including business credit cards, lending, and merchant services. | ❌ Fees for exceeding transaction limits can add up for high-volume businesses. |

The Chase Business Complete Banking account is a powerhouse for small business owners who value both a strong physical presence and integrated digital tools. This account consolidates everyday banking needs into one package. With its vast network, you’re never far from a branch or ATM, which is crucial for businesses that handle cash or require in-person support. The built-in Chase QuickAccept feature is a major business advantage, allowing you to accept card payments and get same-day deposits, which significantly helps manage cash flow.

While there is a monthly maintenance fee, it can be waived by maintaining a minimum balance or through other qualifying activities. This business checking account is an excellent all-in-one solution that grows with your company, offering a clear path to other banking products like small business loans and business credit cards. The robust online banking platform and mobile banking app make account management, bill pay, and monitoring for fraud seamless.

Why We Chose Chase Business Complete Banking

We chose Chase for its unmatched combination of nationwide accessibility and a comprehensive suite of services. For small business owners who want the convenience of handling their checking account, credit card processing, and future business loans all with one financial institution, Chase is one of the best banks for small business. The integration of merchant services directly into the business account is a standout feature that simplifies customer payments.

Key Features

Vast branch and ATM network (4,700+ branches, 15,000+ ATMs)

Chase QuickAccept for same-day deposits from card payments

Fraud protection services, including check monitoring

Online invoicing and bill pay capabilities

Feature-rich mobile banking app for banking on the go

Fees & Other Details

Monthly Fee: $0-12 (waivable)

Transactions: 20 no-fee teller transactions per month; $0.40 thereafter

ATM Fees: $3 for non-Chase ATM withdrawals in the U.S.; $5 for international withdrawals

2. BlueVine Business Checking

Best for Online Businesses Seeking High-Yield Interest on a Checking Account

Pros | Cons |

|---|---|

✔️ No monthly fees or minimum balance requirements on your business account. | ❌ Entirely online with no physical branch locations for in-person support. |

✔️ Earn a highly competitive interest rate on your checking account balance. | ❌ Does not offer reimbursement for out-of-network ATM fees. |

✔️ Allows for cash deposits through the Green Dot network. |

BlueVine stands out in the crowded field of online banking by offering a high-yield business checking account. Small business owners can earn a competitive APY on balances up to $250,000, a feature rarely seen in business checking. This account is ideal for businesses that maintain a healthy cash reserve and want their money to work for them. With no monthly fees, no minimum balance, and unlimited transactions, BlueVine helps keep overhead low.

The account also includes valuable features like free ACH payments and two free checkbooks. For businesses that need to deposit cash, BlueVine partners with the Green Dot network, though a small fee applies. The ability to integrate with popular accounting software makes it easy to manage cash flow and keep financial records in order. Its suite of banking products is tailored for the modern digital business.

Why We Chose BlueVine Business Checking

We chose BlueVine because it directly addresses a major need for many small businesses: earning interest on their operational cash. It flips the script on the traditional business checking model, turning your primary business account into an asset that generates revenue. This, combined with the absence of a monthly fee, makes it one of the top small business banking options for startups and online entrepreneurs.

Key Features

High-yield APY of 1.5% on balances up to $250,000 (with qualifying activity)

Unlimited transactions with no monthly fee

Free ACH and incoming wire transfers

Integrated online invoicing and bill pay

FDIC insurance up to $3 million available through partner banks

Fees & Other Details

Monthly Fee: $0

Transactions: Unlimited

ATMs: No ATM fee reimbursement

3. Mercury

Best for Tech Startups and E-Commerce Businesses Needing API Access

Pros | Cons |

|---|---|

✔️ No monthly fees, minimum balances, or overdraft fees on core banking products. | ❌ No physical branches or ATM network for cash-based operations. |

✔️ Powerful digital tools, including API access for custom banking workflows. | ❌ Fees are charged for foreign currency exchange and premium features. |

✔️ High-yield Treasury option for investing idle cash. |

Mercury is not just a business bank; it’s a financial technology platform designed specifically for startups and internet-first companies. It provides a free business checking account and business savings account with a streamlined account opening process. Where Mercury truly shines is its advanced digital features. It offers API access that allows developers to build custom financial tools, automate payments, and reconcile transactions programmatically.

For well-funded startups, the Mercury Treasury feature provides an easy way to invest excess cash in low-risk money market funds to earn a competitive yield. Features like virtual debit cards, user permissions, and seamless integrations with accounting and payment platforms make it an incredibly powerful tool for tech-savvy business owners.

Why We Chose Mercury

Mercury was chosen for its unparalleled focus on the tech startup ecosystem. The API access and Treasury investment product are features that traditional banks simply don’t offer in their standard small business checking account packages. It’s the best choice for founders who need banking that integrates deeply with their technology stack and financial strategy, helping them manage cash flow efficiently.

Key Features

Free USD checking and savings accounts

IO credit card with no annual fee (subject to credit approval)

Unlimited virtual cards and granular user permissions

API access for programmatic banking

Mercury Treasury for high-yield investments

Fees & Other Details

Monthly Fee: $0 for core banking

Currency Exchange: 1% currency exchange fee for non-USD international wires

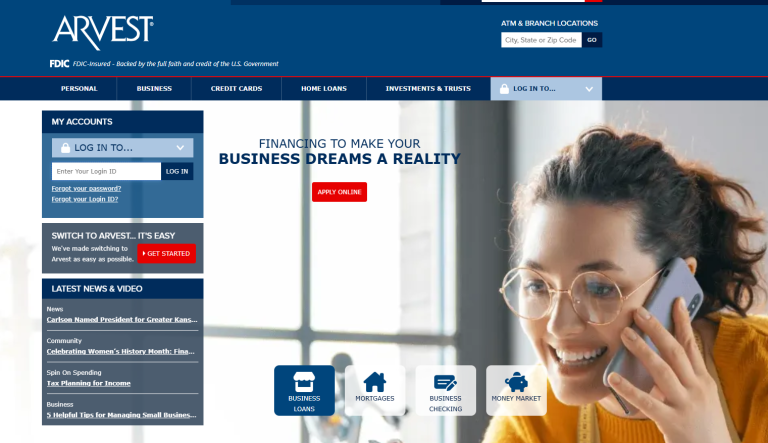

4. Arvest Bank

Best for Regional Businesses in AR, KS, OK, and MO Seeking a Local Touch

Pros | Cons |

|---|---|

✔️ Offers a free basic business checking account with no maintenance waiver needed. | ❌ Service area is limited to Arkansas, Kansas, Oklahoma, and Missouri. |

✔️ Strong focus on local and relationship-based lending. | ❌ Low APYs on business savings account and money market account options. |

Arvest Bank is a regional financial institution that proves a national bank isn’t the only option. For small business owners located in its four-state service area, Arvest provides a community-focused banking experience. Its free business checking account is a major draw, offering 200 free items per month, which is ample for many small businesses. This allows entrepreneurs to avoid monthly maintenance fees without worrying about meeting a minimum balance.

As a community-oriented business bank, Arvest excels in local lending, with small business specialists who understand the regional market. They offer a range of products from standard business bank accounts to specialized financing like commercial real estate loans and agricultural loans. Their mobile banking and online tools cover all the essentials, including mobile deposits and bill pay.

Why We Chose Arvest Bank

Arvest Bank makes the list because it represents the strength of regional banking. Its commitment to providing a genuinely free business checking account, combined with its local lending expertise, offers immense value to small businesses within its footprint. It’s an ideal choice for owners who prefer a personal relationship with their banker.

Key Features

Free Basic Business Checking account

Local lending expertise in agriculture and commercial real estate

Mobile banking app with mobile deposits

Business debit card and credit card options

Standard online banking with bill pay

Fees & Other Details

Monthly maintenance fee: $18

Minimum opening balance: $100

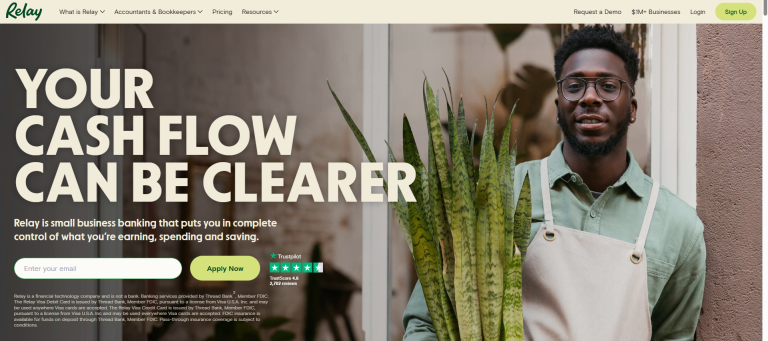

5. Relay

Best for Organizing Cash Flow with Multiple No-Fee Checking Accounts

Pros | Cons |

|---|---|

✔️ No-fee base plan with up to 20 individual business checking accounts. | ❌ No physical branches or proprietary ATM network. |

✔️ Excellent tools for clarifying cash flow and budgeting. | ❌ Same-day ACH payments and other advanced features require a paid “Pro” plan. |

Relay is an online banking platform designed to give small business owners ultimate clarity and control over their finances. Its standout feature is the ability to open up to two business checking accounts (and up to 20 on the free plan) without any extra fees or hassle. This allows you to create separate accounts for operating expenses, payroll, taxes, and profit, making it incredibly easy to manage cash flow using the Profit First methodology or similar systems.

Each account comes with its own account and routing numbers. Relay also offers role-based debit cards, receipt capture, and seamless integrations with leading accounting software like QuickBooks and Xero. The base plan is completely free of monthly fees and includes unlimited ACH payments, making it one of the most cost-effective business bank accounts available.

Why We Chose Relay

We selected Relay for its innovative approach to cash management. The multi-account system is a game-changer for businesses that struggle with budgeting and financial organization. By making it free and easy to segregate funds, Relay empowers business owners to gain a true picture of their financial health, making it one of the best banks for small business focused on profitability.

Key Features

Up to 20 individual checking accounts with no monthly fee

Role-based physical and virtual business debit cards

Automated receipt capture and expense tracking

Budgeting envelopes for precise cash flow management

Direct integrations with QuickBooks Online, Xero, and Gusto

Fees & Other Details

Monthly Fee: $0 for Relay Standard; $30 for Relay Pro

Wires: ACH debit +1% of transaction amount for Relay Standard and ACH debit +0.75% of transaction amount for Relay Pro

6. Wells Fargo

Best for Established Businesses Valuing a Large Branch Network and SBA Lending

Pros | Cons |

|---|---|

✔️ One of the largest nationwide branch and ATM networks in the U.S. | ❌ Monthly maintenance fees apply to most accounts, along with transaction fees. |

✔️ A leading Small Business Administration (SBA) lender. | ❌ Foreign transaction fees are charged on its business debit card. |

Wells Fargo is a traditional banking giant that offers a deep well of resources for established small businesses. Its extensive branch network makes it a convenient choice for companies that require frequent in-person banking services. Wells Fargo offers several tiers of business checking accounts, including an analysis business checking account for companies with high transaction volumes and complex cash management needs.

A key business advantage of Wells Fargo is its status as a top SBA lender, providing a reliable path to securing small business loans for growth and expansion. Its online banking and mobile banking app are robust, offering Zelle for Business, mobile deposits, online bill pay, and advanced fraud alerts. This combination of physical presence and digital capability makes it a solid choice for many business owners.

Why We Chose Wells Fargo

Wells Fargo was chosen for its strength and reliability as a full-service commercial bank. For businesses that have moved beyond the startup phase and require a banking partner that can provide significant business credit, SBA loans, and sophisticated merchant services, Wells Fargo is a top contender. Its vast network ensures support is always nearby.

Key Features

Zelle for Business for fast and easy customer payments

Mobile deposits and comprehensive mobile banking app

Advanced fraud alerts and debit card controls

Extensive branch and ATM network

Multiple tiers of business checking, including Initiate, Navigate, and Optimize

Fees & Other Details

Monthly Fee: Starts from $10

Transactions: 100 free transactions per month; $0.50 thereafter

7. Bank of America Business Advantage Fundamentals™ Banking

Best for Businesses Seeking Rewards Programs and a Large National Footprint

Pros | Cons |

|---|---|

✔️ Large national network of branches and ATMs. | ❌ Fees on foreign transactions and using a debit card internationally can be high. |

✔️ Excellent Preferred Rewards for Business program offers valuable perks. | ❌ Non-customers may face fees for certain in-branch services. |

Bank of America offers a compelling package for small business owners through its Business Advantage Fundamentals™ Banking account. Like other large national bank players, it boasts a massive network for easy access to in-person services. However, its true differentiator is the Preferred Rewards for Business program. Businesses that maintain qualifying balances across their eligible business checking accounts and a Merrill business investment account can unlock perks like interest rate boosters on a business savings account, no fees on select services, and credit card rewards bonuses.

The Business Advantage Relationship Banking model is designed to reward customers for consolidating their finances. The digital banking platform is top-notch, with an excellent mobile banking app, Zelle integration, and tools to help manage cash flow. New business owners can also benefit, as the monthly fee is waived for the first 12 statements for new accounts.

Why We Chose Bank of America

Bank of America stands out because of its powerful rewards program. For businesses that can meet the balance requirements, the Preferred Rewards program can deliver significant value, effectively creating a suite of premium, low-cost banking products. This focus on rewarding loyalty, combined with its strong digital tools and national reach, makes it a top choice.

Key Features

Preferred Rewards for Business program

Full-featured digital banking with mobile check deposit and Zelle

Online bill pay and digital check imaging

Access to small business specialists for guidance

Integration with QuickBooks and Merrill investment insights

Fees & Other Details

Monthly Fee: No fee for 12 months, then $16/month

Transactions: Fees vary

8. Capital One Spark Business Checking

Best for Digital-First Businesses Wanting Fee-Free ATMs and Unlimited Transactions

Pros | Cons |

|---|---|

✔️ No fees at over 70,000 Allpoint® and MoneyPass® ATMs nationwide. | ❌ Maintaining a minimum balance is required to waive the monthly fee. |

✔️ Unlimited digital transactions on both checking tiers. | ❌ Physical branch footprint is more limited than other large national banks. |

✔️ Scalable account tiers to grow with your business. |

Capital One’s Spark Business Checking accounts offer a fantastic hybrid experience, blending powerful digital features with practical, real-world access. The standout feature is the unlimited fee-free digital transactions, which is ideal for businesses that conduct most of their banking online. When cash is needed, Capital One provides access to a massive network of over 70,000 fee-free ATMs, one of the largest available.

The account comes in two tiers: Basic and Enhanced. The Enhanced tier offers additional perks like free incoming wires and five free outgoing wires per month. While there is a monthly fee, it’s easily waived by maintaining a reasonable average balance. Capital One’s online and mobile banking tools are user-friendly, providing everything a small business needs for daily financial management, including mobile deposits and online bill pay.

Why We Chose Capital One Spark Business Checking

Capital One earns its spot by offering a best-of-both-worlds solution. The combination of unlimited digital transactions and a vast, fee-free ATM network provides incredible flexibility. This makes it one of the best banks for small business owners who operate primarily online but still want the security and convenience of easy cash access without the fees.

Key Features

Unlimited digital transactions

Fee-free access to 70,000+ ATMs via Allpoint and MoneyPass

Free wires available on the enhanced checking tier

Mobile deposits and debit card with cash-back on eligible purchases

Advanced security options like Lockbox and positive pay

Fees & Other Details

Monthly Fee: $15 (waivable with a $2,000 average balance)

Fees: Unlimited free digital transactions including mobile deposits, ACH payments, and select online bill pay options.

9. U.S. Bank Business Essentials® Checking

Best for Startups and Sole Proprietors Needing a Fee-Free Basic Business Checking Account

Pros | Cons |

|---|---|

✔️ No monthly maintenance fee on the basic business checking account. | ❌ Fees apply for out-of-network ATM use. |

✔️ Robust digital tools and access to a large ATM network. | ❌ A limited number of free branch transactions before fees are incurred. |

For new small business owners, keeping costs low is a top priority. The U.S. Bank Business Essentials® Checking account (formerly Silver Business Checking) is designed for this exact purpose. Its most attractive feature is the $0 monthly fee, which requires no minimum balance to maintain. This allows entrepreneurs to establish a professional business account at a large, reputable national bank without adding to their monthly overhead.

While the account has limits on free branch transactions and cash deposits, the allowances are often sufficient for many startups and service-based businesses. U.S. Bank complements this with strong online banking and a highly-rated mobile banking app, which includes free mobile deposits, ACH payments, and bill pay. This makes it an excellent starter account that provides all the essential tools for success.

Why We Chose U.S. Bank

U.S. Bank is included because it provides one of the best entry points into business banking. The ability to get a feature-rich checking account from a major financial institution with no monthly fee is a significant business advantage for startups. It removes a key barrier, allowing business owners to professionalize their finances from day one.

Key Features

$0 monthly fee

Free online and mobile banking with mobile deposits

Access to over 50,000 fee-free ATMs in the U.S. Bank and MoneyPass networks

Check scanner options for businesses with higher check volumes

ACH, bill pay, and Direct Pay services for managing payments

Fees & Other Details

Monthly Fee: $0

Transactions: 25 free branch transactions per month

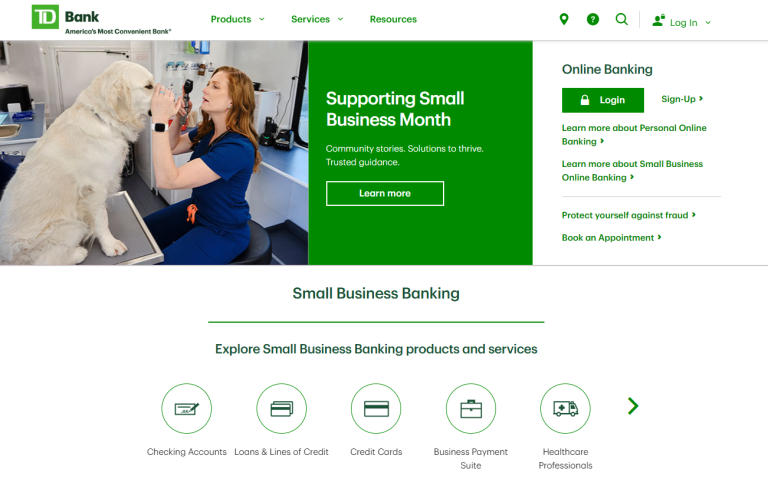

10. TD Bank Simple Business Checking

Best for East Coast Businesses Needing Weekend and Extended Branch Hours

Pros | Cons |

|---|---|

✔️ Many branches offer extended hours, including weekends. | ❌ Out-of-network ATM fees are higher than some competitors. |

✔️ Offers specialized banking solutions for practices like medical and legal. | ❌ Geographic footprint is primarily limited to the U.S. East Coast. |

TD Bank brands itself as “America’s Most Convenient Bank,” and for many small business owners on the East Coast, it lives up to the name. Its key differentiator is accessibility; many branches are open on weekends and have longer weekday hours than typical banks. This can be a crucial perk for retail, restaurant, or service-based businesses that don’t operate on a standard Monday-to-Friday, 9-to-5 schedule.

The TD Simple Business Checking account offers a generous 300 free items per month, and the modest monthly fee is waived with a low minimum balance. The bank provides all the modern digital tools you’d expect, including a digital wallet, free online bill pay, mobile deposits, and Zelle for Business. It’s a solid, traditional business bank account backed by exceptional convenience.

Why We Chose TD Bank

TD Bank makes our list for its unique commitment to convenience through extended hours. For a significant segment of small business owners, the ability to do their banking after normal work hours or on a Sunday is not a small perk—it’s a necessity. This focus on customer service, combined with solid banking products, makes it an outstanding choice within its service area.

Key Features

Extended branch hours, including on weekends

Digital wallet compatibility (Apple Pay, Google Pay, Samsung Pay)

Free online bill pay and mobile deposits

Zelle for Business integration

Specialized banking options for different industries

Fees & Other Details

Monthly Fee: $10

Transactions: 300 free items per month; $0.35 thereafter

Of course. Here is the content with the titles adjusted to be more direct, as requested.

What Is a Business Bank Account?

For new small business owners, it can be tempting to use a personal account for business transactions. However, a dedicated business bank account is a foundational tool for financial health and legal protection. At its core, a business account is a checking or savings account used exclusively for a company’s financial activities—receiving payments from customers and paying for expenses like inventory, payroll, and rent.

The primary function is to create a clear legal separation between you and your business. For entities like LLCs and corporations, this separation is crucial for maintaining liability protection. Mingling funds can “pierce the corporate veil,” putting your personal assets at risk in the event of a lawsuit. Beyond legalities, a dedicated business bank account streamlines bookkeeping, simplifies tax preparation, and presents a more professional image to clients. It’s also the gateway to essential financial products. Establishing a relationship with a business bank is the first step toward qualifying for business credit, business loans, and a merchant account to process credit card payments.

Common Business Bank Account Terms You Need to Know

Navigating the world of business banking can feel like learning a new language. Understanding these common terms will empower you to choose the right account and manage it effectively.

Business Checking Account: The primary transactional account for your business. It’s used for daily operations, including deposits, withdrawals, writing checks, and making electronic payments.

Business Savings Account & Money Market Account: These accounts are designed for holding cash reserves you don’t need immediately. A business savings account is a basic, interest-bearing account. A money market account often offers a higher interest rate than a standard business savings but may require a higher minimum balance. Both are excellent tools for growing your business savings.

Monthly Maintenance Fee: A recurring fee the bank charges to maintain your account. The best banks for small business often provide simple ways to waive this fee, such as by maintaining a minimum balance. Understanding how banks calculate your fees and interest is crucial, especially when it comes to maintaining minimum balances. One of the most common methods banks use is the average daily balance method, which determines the account balance each day and averages it over the billing period. This calculation affects your monthly maintenance fees, interest earnings, and can influence whether you meet minimum balance requirements. Familiarizing yourself with the Average Daily Balance can help you manage your account more effectively and avoid unexpected charges.

APY (Annual Percentage Yield): The total amount of interest you’ll earn on a deposit account over one year, including the effect of compounding interest. A higher APY means more growth for your money.

Transaction Limits: The number of fee-free transactions (like deposits, withdrawals, and transfers) allowed per month. Exceeding this limit usually results in a per-item fee. Online-focused banks often offer unlimited transactions.

How to Open A Business Bank Account?

Opening a business bank account is a straightforward process. Following these steps will ensure you are prepared and can get your account active quickly.

Choose the Right Bank: Review the options in this guide and select the business bank that best fits your needs, considering factors like fees, branch access, and digital features.

Gather Your Documents: Banks are required by law to verify your business’s identity. While requirements vary slightly, you will typically need:

Personal Identification: A government-issued photo ID for all owners.

Employer Identification Number (EIN): Your business’s federal tax ID number. Sole proprietors can often use their Social Security Number.

Business Formation Documents: This includes your Articles of Incorporation (for corporations), Articles of Organization (for LLCs), or Partnership Agreement.

Business Licenses: Any relevant local, state, or federal licenses required to operate your business.

Complete the Application: Many banks now allow you to complete the entire application process through their online banking portal, which is a convenient option. Alternatively, you can visit a local branch to open the account in person.

Fund Your Account: You’ll need to make an initial deposit to activate the account. The minimum deposit amount varies by bank and account type, so check the requirements beforehand. Once funded, you’ll receive your debit card and checkbook, and you can start managing your business finances.

Our Evaluation Criteria

To identify the best banks for small business, we conducted a comprehensive analysis based on the factors that matter most to small business owners. Our methodology focused on four key pillars:

Cost and Fees: We scrutinized monthly maintenance fees, transaction fees, wire fees, and ATM charges. We prioritized institutions that offer fee-free accounts or provide clear and achievable ways to waive monthly fees.

Accessibility and Convenience: We evaluated both physical and digital access. This included the size of branch and ATM networks as well as the quality and functionality of each bank’s online banking platform and mobile app.

Features and Services: We looked beyond the basic checking account to assess the entire ecosystem of products. This included the availability of high-yield business savings accounts, integrated tools like invoicing and payment processing, and streamlined access to other critical services.

Scalability: A business’s needs change as it grows. We considered how well each bank supports this journey, from a simple starter account to providing access to essential growth tools like business credit, business loans, equipment financing, and a full-service merchant account. Our goal is to provide a list that serves a business not just for today, but for its future success.

Frequently Asked Questions (FAQs)

What are the key features that the best banks for small businesses typically offer?

The best banks for small business offer low or waivable monthly fees, a sufficient number of free transactions, convenient access through nationwide branches or robust online banking, and a suite of integrated services including business credit cards and loans.

How does a bank’s online banking platform benefit small business owners?

An online banking platform benefits small business owners by providing 24/7 access to account management, tools for bill pay and invoicing, mobile check deposits, and streamlined cash flow monitoring, saving valuable time and improving efficiency.

What is the difference between a business savings account and a money market account?

A business savings account is a basic account for holding cash reserves and earning interest. A money market account is similar but often offers a higher interest rate in exchange for a higher minimum balance and may provide limited check-writing capabilities.

What role does a bank play in helping a business establish business credit?

A bank plays a crucial role by providing the initial business bank account, which is the first step in separating business and personal finances. It then offers products like business credit cards and small business loans, which, when used responsibly, help build a strong business credit history.

Is it necessary for a business to have a merchant account to accept business loans?

No, a merchant account is not necessary to accept business loans. A merchant account is specifically for processing credit and debit card payments from customers, while business loans are capital provided by a lender that is deposited into a business bank account.

Conclusion

Finding the right financial partner is a journey that evolves with your company. While you might start with a simple account offering perks like free cash deposits, your needs will grow. The ideal bank will be ready to support that growth with a suite of products, from a business advantage savings account and business interest checking to business CDs or a more complex dynamic business checking account for sophisticated cash management.

Beyond deposit accounts, consider the full ecosystem of services. A strong banking relationship can simplify operations with integrated payroll services, a seamless merchant account for customer payments, and access to capital through small business credit cards or equipment financing. A robust financial institution’s online platform is non-negotiable in today’s digital world. Don’t forget to also explore local credit unions, which can offer competitive and personalized services.

As you evaluate options, note that many digital payment features, often managed by entities like Early Warning Services, LLC—a wholly owned subsidiary of major banks—provide rapid transactions once processing for enrolled users typically occur. All trade names and service marks mentioned are the property of their respective institutions.