Managing payroll is one of the most critical tasks for small businesses, yet it often proves to be one of the most challenging. The right payroll system can help small business owners automate the payroll process, ensure compliance with tax laws, and streamline payroll tasks such as tax filings, new hire reporting, and managing employee benefits. Whether you are calculating wages, handling contractor payments, or processing payroll taxes, choosing the best payroll service provider is vital for your business’s success. The best payroll software can save time, minimize costly mistakes, and ensure timely payments, which ultimately helps keep your employees happy and your business running smoothly.

There are various payroll solutions available, each catering to different needs. Some systems excel in automated payroll, while others focus on providing comprehensive HR tools, including workers’ compensation, tax filings, and benefits management. Payroll systems that integrate with accounting software, like QuickBooks Payroll, can help small business owners save time and avoid errors. Others, like Gusto and Paychex, offer powerful self-service portals, allowing employees to access pay stubs, manage benefits, and even track time. In this guide, we’ll explore some of the best small business payroll processing systems, looking at their features, pricing, and how they help simplify payroll management for small businesses.

Save 80% of delivery management time

"Got 10 hours/week back by outsourcing deliveries"— Mo, BoardsByMoWe handle everything:

- Dedicated operations manager

- Real-time tracking dashboard

- Automated customer notifications

- Urgent issue resolution

What are the best small business payroll processing systems?

Gusto: Best for user-friendly payroll and tax filing.

QuickBooks: Best for businesses using QuickBooks accounting.

Paychex: Best for scalable payroll and HR tools.

Patriot: Best for affordable payroll.

OnPay: Best for all-in-one payroll and HR.

We’ve carefully analyzed the top payroll processing systems for small businesses, focusing on ease of use, pricing, and essential features. From affordable options to all-in-one solutions, each of our picks excels in different areas. Let’s dive into the details of each system to see which one could be the right fit for your business needs. When it comes to selecting the ideal payroll solution, understanding its core advantages is essential. From simplifying tax compliance to enhancing employee satisfaction, there are compelling reasons for selecting the right payroll software. For an in-depth look, consider exploring these key points about the process of finding the perfect system by checking out this article on 5 essential reasons for selecting payroll software.

Top 5 Small Business Payroll Software in 2024

Payroll System | Rating | Base Monthly Price | Automated Payroll | Key Features |

|---|---|---|---|---|

Gusto | ⭐⭐⭐⭐½ (4.5) | $39/month + $6/employee | Yes | Automated tax filings, employee onboarding, unlimited payroll runs |

QuickBooks | ⭐⭐⭐⭐ (4.4) | $50/month + $6/employee | Yes | Seamless QuickBooks integration, direct deposit, tax penalty protection |

Paychex | ⭐⭐⭐⭐ (4.3) | Starting at $39/month | Yes | Scalable HR tools, mobile app, payroll and tax filing |

Patriot | ⭐⭐⭐⭐½ (4.5) | $12/month + $4/employee | Yes | Affordable plans, unlimited payroll runs, contractor payments |

OnPay | ⭐⭐⭐⭐ (4.4) | $40/month + $6/employee | Yes | All-in-one payroll and HR, benefits management, easy employee access |

1. Gusto

Rating: ⭐⭐⭐⭐⭐ (4.8/5) (G2)

Pros | Cons |

|---|---|

✔️ User-friendly interface for small businesses | ❌ Limited phone support during off-peak hours |

✔️ Automated tax filing simplifies payroll tasks | ❌ Some features require additional fees |

✔️ Excellent HR and benefits integration | ❌ Not ideal for scaling larger businesses |

✔️ Flexible payroll schedule and unlimited runs | ❌ Reporting features could be more advanced |

✔️ Employee self-service portal |

Our Take

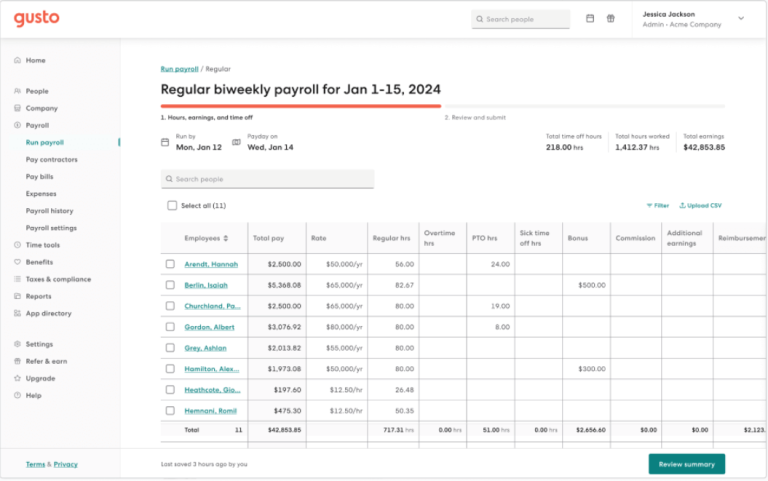

Gusto Payroll is a standout option among the best payroll systems for small businesses, offering an intuitive and comprehensive platform for managing payroll and HR tasks. With Gusto, small business owners can easily handle the entire payroll process, from calculating wages to filing payroll taxes, ensuring compliance with local and federal tax laws. Its automated payroll features save time and minimize the risk of costly mistakes, such as incorrect tax filings or late submissions.

Gusto goes beyond basic payroll by integrating key HR functionalities like benefits management, new hire reporting, and compliance tracking, making it an all-in-one payroll solution for small businesses. Its self-service portal allows employees to access pay stubs, tax documents, and direct deposit information with just a few clicks. While Gusto excels in usability and features, its advanced reporting tools and scalability may fall short for rapidly growing companies or enterprises with complex payroll data requirements. Effective payroll software is not just about timely payments and accurate tax filings; it can significantly enhance your business’s scalability. By automating various processes, payroll software allows you to focus on growth instead of administrative tasks. For more details on how payroll software can enhance your business operations, check out this insightful piece on how payroll software can boost your business scale.

Effective payroll software not only ensures timely payments and accurate tax filings but also significantly enhances your business’s scalability. By automating various processes, payroll software allows you to prioritize growth over administrative tasks. If you’re interested in learning more about this, we recommend reading this article on how payroll solutions can elevate your business scale.

Key Features

Automated Tax Filing: Handles payroll tax calculations and submissions, including local taxes.

Unlimited Payroll Runs: Flexible scheduling to process payroll as often as needed.

HR and Benefits Management: Streamlined new hire reporting, benefits integration, and compliance tools.

Employee Self-Service Portal: Provides employees easy access to payroll information and tax forms.

Time Tracking Integration: Seamlessly syncs with time tracking systems for accurate payroll data.

Who’s it for?

Gusto is ideal for small business owners looking for a user-friendly platform that integrates payroll and HR functions. Its automation features suit businesses aiming to save time and focus on growth while avoiding tax penalties.

Pricing Details

Core Plan: $39/month + $6/employee/month.

Complete Plan: $39/month + $12/employee/month.

Concierge Plan: $149/month + $12/employee/month.

Why we recommend Gusto Payroll

Gusto stands out as one of the best payroll software solutions for small businesses due to its intuitive design and feature-rich platform. It simplifies handling payroll tasks like tax filings, benefit deductions, and payroll taxes, ensuring compliance with government agencies. Its unlimited payroll runs and seamless integrations with accounting software like QuickBooks Online allow business owners to run payroll efficiently.

Additionally, Gusto’s HR tools, including new hire reporting and employee benefits management, make it a comprehensive payroll service provider. The self-service portal adds convenience for employees, empowering them to manage their own payroll data, and reducing administrative tasks for employers.

For small business payroll processing, Gusto provides an exceptional balance of affordability, features, and ease of use, making it the right payroll provider for many companies embarking on their business journey.

What Gusto Payroll could improve

While Gusto is an excellent payroll solution, it could benefit from enhancements to its advanced reporting tools, which some users find limited for in-depth payroll reports and project tracking. This improvement would appeal to businesses needing detailed analytics for job costing or long-term financial planning.

Furthermore, expanding customer support availability would help address payroll queries during critical times, such as weekends or late evenings, particularly during busy tax filing periods. Finally, adding more scalability options would make Gusto a better fit for small businesses transitioning into mid-sized organizations.

By addressing these areas, Gusto could further solidify its position as one of the most comprehensive and versatile payroll systems available.

2. QuickBooks

Rating: ⭐⭐⭐⭐½ (4.6/5) (Capterra)

Pros | Cons |

|---|---|

✔️ Seamless integration with QuickBooks Online | ❌ Higher cost compared to some competitors |

✔️ Automated tax calculations | ❌ Limited advanced HR features |

✔️ Same-day direct deposit option | ❌ Customer support can be inconsistent |

✔️ Mobile app for on-the-go payroll tasks | ❌ Setup process can be time-consuming |

✔️ Customizable payroll schedule |

Our Take

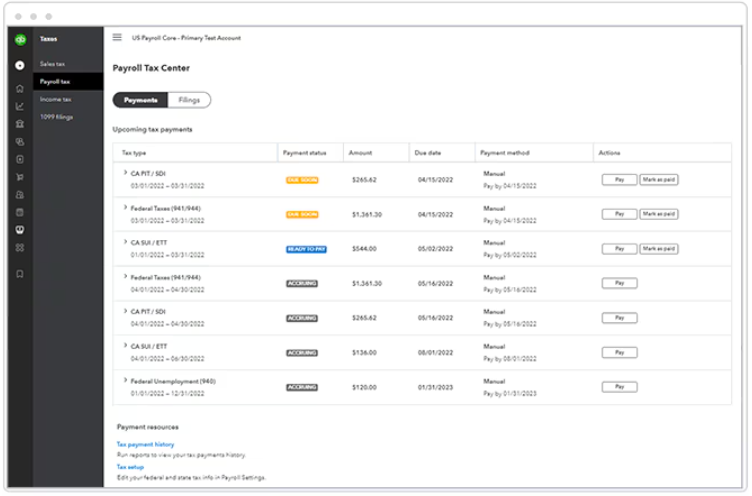

QuickBooks Payroll is a natural choice for small businesses that are already using QuickBooks accounting software. Its integration enables seamless syncing of payroll data, eliminating redundant data entry and simplifying the overall payroll process. Features such as automated tax filing, same-day direct deposit, and comprehensive payroll reports make QuickBooks Payroll a robust payroll solution for businesses aiming to streamline operations and reduce administrative tasks.

QuickBooks Payroll excels in offering flexible scheduling and unlimited payroll runs, giving small business owners full control over how and when to process payroll. The mobile app allows for payroll management on the go, a vital feature for today’s busy entrepreneurs. While its pricing is on the higher side, the value it provides through advanced tools, compliance features, and ease of use justifies the cost for many businesses.

Key Features

Same-Day Direct Deposit: Pay employees faster without additional delays.

Automated Tax Filings: Handles federal, state, and local tax submissions with accuracy.

Employee Benefits Integration: Supports benefits management, including workers’ compensation.

Mobile App: Manage payroll tasks, access reports, and run payroll from anywhere.

Custom Payroll Reports: Generate detailed insights into payroll costs and tax filings.

Who’s it for?

QuickBooks Payroll is ideal for small businesses that are already using QuickBooks for accounting. It’s best for those who value seamless integration, fast payroll processing, and automated compliance tools.

Pricing Details

Payroll Core: $50/month + $6/employee/month.

Payroll Premium: $85/month + $9/employee/month.

Payroll Elite: $130/month + $11/employee/month.

Why we recommend QuickBooks Payroll

QuickBooks Payroll is a top-tier payroll service provider, especially for small businesses relying on QuickBooks Online for bookkeeping. Its seamless integration allows users to efficiently manage payroll and accounting tasks in one platform, avoiding costly mistakes that arise from manual data entry.

Its automated payroll features, including tax calculations and filings, reduce the burden of compliance with local tax laws and government agencies. Business owners can run payroll in just a few clicks while leveraging same-day direct deposit to pay employees quickly. Furthermore, the mobile app ensures flexibility, enabling small business owners to handle payroll and HR tasks anytime, anywhere.

QuickBooks Payroll is a reliable and efficient choice for businesses seeking to streamline their payroll schedule while maintaining compliance and accuracy.

What QuickBooks Payroll could improve

While QuickBooks Payroll provides robust small-business payroll processing, its pricing might be prohibitive for startups or businesses on a tight budget. Offering a more affordable tier without compromising essential payroll features could make it accessible to more small business owners.

The setup process could also be simplified to better accommodate users unfamiliar with payroll systems. Additionally, expanding customer support hours and improving response times would ensure smoother transitions for new users and better handling of payroll emergencies. Addressing these areas would elevate QuickBooks Payroll further as a leader in small business payroll software.

3. Paychex

Rating: ⭐⭐⭐⭐ (4.2/5) (G2)

Pros | Cons |

|---|---|

✔️ Comprehensive HR and payroll features | ❌ Higher pricing for advanced plans |

✔️ Scalable for growing businesses | ❌ Customer support can be inconsistent |

✔️ Mobile app for payroll and HR tasks | ❌ Steeper learning curve for beginners |

✔️ Automated tax filing | ❌ Limited customization for smaller firms |

✔️ Dedicated professional employer organization (PEO) services |

Our Take

Paychex stands out as a versatile payroll solution suitable for small to medium-sized businesses seeking both payroll and HR management tools. With features such as automated payroll processing, benefits management, and tax filings, it provides a one-stop shop for handling payroll and HR tasks effectively.

Paychex Flex, the company’s flagship platform, offers scalable plans that grow with your business needs, making it ideal for companies planning to expand their workforce. The platform is user-friendly for tech-savvy users but might pose challenges for newcomers due to its feature-rich design.

Its mobile app ensures that payroll tasks can be handled on the go, providing flexibility for business owners and HR teams. The integration with HR tools also simplifies employee onboarding and management. While pricing might seem steep, the value Paychex adds with its payroll and HR capabilities makes it a strong contender among the best payroll systems for small businesses.

Key Features

All-in-One Payroll and HR: Combines payroll processing with HR management tools.

Mobile Payroll App: Manage payroll data, employee benefits, and tax forms from anywhere.

Scalable Solutions: Tailored plans for businesses of various sizes.

Compliance Assistance: Ensures adherence to local, state, and federal tax laws.

PEO Services: Professional employer organization support for managing employee benefits and legal compliance.

Who’s it for?

Paychex is a great fit for small businesses and medium-sized enterprises looking for an integrated payroll and HR solution with scalable features that grow alongside their business.

Pricing Details

Essentials Plan: Starting at $39/month.

Select Plan: Starting at $44/month.

Pro Plan: Starting at $89/month.

Why we recommend Paychex

Paychex offers a unique balance of payroll services and advanced HR features, making it a comprehensive payroll provider for small businesses aiming to streamline administrative tasks. The all-in-one payroll platform ensures seamless payroll processing, compliance, and benefits management, saving business owners valuable time and resources.

The PEO services make Paychex particularly appealing to businesses needing professional guidance on benefits, compliance, and tax filings. For small business owners looking to avoid tax penalties and focus on their business journey, Paychex provides ongoing guidance and tools to handle payroll and HR tasks with ease.

What Paychex could improve

While Paychex excels in payroll and HR tools, the platform’s pricing may deter smaller companies with limited budgets. Introducing more affordable plans tailored for startups could widen its reach.

Improving customer support and simplifying the user experience for new clients would also enhance its appeal. For small businesses navigating payroll for the first time, a smoother onboarding process would reduce the learning curve and ensure they can run payroll effectively from day one.

4. Patriot

Rating: ⭐⭐⭐⭐⭐ (4.8/5) (Capterra)

Pros | Cons |

|---|---|

✔️ Affordable pricing | ❌ Limited advanced HR features |

✔️ Unlimited payroll runs | ❌ No mobile app for payroll management |

✔️ Easy-to-use interface | ❌ Lacks integrations with large platforms |

✔️ Excellent customer support | |

✔️ Supports multiple pay frequencies |

Our Take

Patriot Payroll is a budget-friendly payroll software designed for small businesses seeking a straightforward and reliable payroll solution. Its affordability and ease of use make it ideal for startups or companies handling small business payroll processing for the first time.

The software provides unlimited payroll runs, allowing businesses to process payroll as frequently as needed without additional costs. Patriot also offers strong customer support, ensuring small business owners can navigate payroll tasks and resolve issues quickly. While it lacks advanced HR features and a mobile app, its focus on simplicity and affordability makes it a valuable option for small business owners.

Key Features

Unlimited Payroll Runs: Process payroll as often as needed without extra charges.

Simple User Interface: Intuitive design for easy navigation and handling payroll.

Flexible Pay Schedules: Supports weekly, bi-weekly, and monthly payroll.

Federal and State Tax Filing: Helps with accurate tax submissions.

Affordable Pricing: Cost-effective plans tailored for small businesses.

Who’s it for?

Patriot Payroll is ideal for small businesses and startups seeking affordable payroll services with no hidden fees and easy-to-use tools.

Pricing Details

Basic Plan: $12/month + $4/employee/month.

Full-Service Plan: $25/month + $4/employee/month.

Why we recommend Patriot Payroll

Patriot Payroll is one of the most affordable and user-friendly payroll systems available, making it the right payroll provider for small business owners aiming to manage payroll efficiently without breaking the bank. The software’s ability to handle payroll taxes, multiple pay frequencies, and tax documents ensures accuracy and compliance.

Patriot’s commitment to simplicity makes it ideal for business owners handling payroll tasks independently, providing a low-cost yet effective payroll service for small businesses.

What Patriot Payroll could improve

Patriot could benefit from developing a dedicated mobile app for payroll tasks, enabling users to access payroll data and run payroll on the go. Adding integrations with more prominent accounting software and HR tools would also enhance its usability for growing businesses.

5. OnPay

Rating: ⭐⭐⭐⭐½ (4.7/5) (Capterra)

Pros | Cons |

|---|---|

✔️ Straightforward pricing | ❌ Limited advanced reporting features |

✔️ Comprehensive payroll and HR tools | ❌ Not ideal for large enterprises |

✔️ Automated tax filings | ❌ Limited third-party integrations |

✔️ User-friendly interface | |

✔️ Excellent customer support |

Our Take

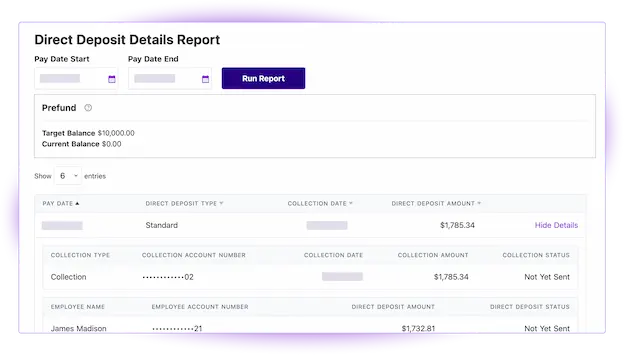

OnPay is an all-in-one payroll system combining payroll processing and basic HR features. Its transparent pricing model and automated compliance tools make it a standout option for small business owners looking to save time on administrative tasks.

OnPay simplifies running payroll with automated tax filings, pay stubs, and direct deposits, allowing businesses to file taxes and pay employees accurately. While it lacks the advanced reporting features needed for larger enterprises, it offers excellent value for small businesses that need an efficient, straightforward payroll solution.

Key Features

-

Transparent Pricing: Flat-rate pricing with no hidden fees.

-

HR Features: Includes new hire reporting and benefits management.

-

Automated Tax Filings: Ensures compliance with federal and local tax laws.

-

Employee Self-Service: Provides a self-service portal for CVS pay stubs and tax forms.

-

Multi-State Payroll: Supports businesses with employees in different states.

Who’s it for?

OnPay is perfect for small businesses seeking a cost-effective and reliable payroll provider with easy-to-use tools and integrated HR features.

Pricing Details

-

Flat Rate: $40/month + $6/employee/month.

Why we recommend OnPay

OnPay’s flat-rate pricing and straightforward design make it one of the best payroll systems for small businesses. Its comprehensive features ensure accurate payroll processing, compliance, and employee satisfaction. Small businesses can handle tax filings, employee benefits, and payroll schedules efficiently, all while avoiding costly mistakes.

OnPay’s strong customer support and automated compliance tools make it a dependable payroll service provider for business owners looking to streamline administrative tasks.

What OnPay could improve

OnPay could expand its reporting capabilities to better serve growing businesses with more complex needs. Adding integrations with additional accounting software would also increase its appeal as a scalable solution for companies planning to expand their payroll and HR operations.

How We Chose the Best Payroll Services: Our Methodology

Our analysis of the best payroll systems for small businesses focused on critical areas to ensure the services we recommend meet a variety of business needs. Each provider was evaluated on its core functionality, usability, pricing, and customer support, among other factors.

We began by examining features—key aspects like automated payroll processing, tax filings, direct deposit, and compliance with local and federal tax laws. Services that integrated well with accounting software, time-tracking tools, or HR systems were given higher priority, as these integrations streamline the payroll process and reduce administrative tasks.

Ease of use was another essential category. We looked for intuitive platforms with straightforward navigation and mobile accessibility, ensuring they cater to both payroll novices and experienced users. Tools that simplify complex payroll processes, like calculating deductions and generating tax forms, scored higher in this area.

Pricing was evaluated with transparency and value in mind. We compared base costs, additional fees for services like benefits management or multi-state payroll, and whether free trials or scalable pricing plans were available for businesses of different sizes.

Customer support played a significant role. Small businesses often need reliable guidance, so we assessed availability, responsiveness, and the quality of support channels such as phone, live chat, and 24/7 assistance. Services with comprehensive help centers and ongoing support options were favored.

Lastly, we factored in user reviews from reputable sources like G2 and Capterra. Real-world feedback helped us gauge reliability, identify common issues, and verify performance claims made by providers.

By combining these categories, we ensured a well-rounded evaluation of payroll software and services that address the diverse needs of small businesses. This methodology allowed us to present accurate, practical recommendations for simplifying payroll processes.

What Are Payroll Services?

Payroll services refer to the management and administration of employees’ salaries, wages, bonuses, and deductions. These services can include calculating wages, processing payroll, withholding and filing payroll taxes, managing benefits, and providing pay stubs. Small businesses often use payroll service providers to simplify complex tasks such as tax filings, compliance with labor laws, and ensuring timely employee payments. Payroll services can either be handled in-house with software or outsourced to external payroll service providers, depending on a business’s needs.

Payroll services ensure that companies meet local and federal tax obligations, avoid costly mistakes, and keep their employees satisfied with timely and accurate payments. Most payroll services today also offer HR solutions, benefits management, and tools for managing employees’ time off and tracking their working hours.

What Types of Payroll Solutions Are Available?

Payroll solutions cater to a variety of business needs, ranging from basic to comprehensive options:

-

In-House Payroll Software: Ideal for small businesses with straightforward payroll needs, these solutions offer control and affordability. Examples include Gusto and Patriot Payroll.

-

Outsourced Payroll Services: Larger businesses or those with complex requirements often outsource payroll to providers like Paychex, which handles all aspects of payroll processing and compliance.

-

Professional Employer Organizations (PEOs): These companies take on full HR responsibilities, including payroll, benefits administration, and compliance.

-

Hybrid Solutions: A blend of software and service, offering flexibility and tailored options for growing businesses.

Key Differences Between Payroll Software and Payroll Services

Payroll software and payroll services are both essential tools for businesses to handle payroll tasks, but they differ in the level of involvement, automation, and outsourcing. Payroll software is a tool that businesses use to manage payroll tasks internally. It helps automate the calculation of wages, deductions, and taxes, streamlining payroll processing. However, the responsibility for filing taxes, ensuring compliance with labor laws, and managing the complexities of payroll still falls on the business itself. Payroll software is typically a good fit for businesses that have the internal resources to handle payroll and want more control over the process.

On the other hand, payroll services are typically outsourced solutions where a payroll service provider takes on the responsibility of handling the entire payroll process. This includes everything from calculating and processing payroll, filing tax forms, and handling direct deposits to ensuring compliance with all relevant tax laws. Payroll services offer a higher level of convenience and peace of mind because the business doesn’t need to worry about tax filings or regulatory compliance, as the service provider manages these tasks. This is ideal for small businesses that want to focus on growth and avoid the administrative burden of payroll management.

Choosing the Right Payroll Service for Your Business

Choosing the right payroll service can make a significant difference in how smoothly your small business operates. Payroll processing is a critical aspect of your business that affects your employees’ satisfaction and compliance with tax laws. With many payroll service providers available, understanding how to choose the one that best fits your needs is essential. Below are several crucial factors to consider when selecting a payroll service. Beyond payroll, efficient business operations often depend on optimizing logistics such as delivery routes and schedules. Implementing effective route optimization strategies can save time and reduce costs, complementing streamlined payroll systems to enhance overall operational efficiency.

1. Assess Your Payroll Complexity

The first step in choosing a payroll provider is to assess the complexity of your payroll needs. For example, do you have a small number of employees, or are you dealing with multiple workers across various states? The more employees you have and the more diverse your business is, the more complex your payroll becomes. Look for a payroll service that can handle your current and future needs as your business grows.

For instance, businesses that operate across multiple states need a service that can manage multi-state tax filings and handle complex payroll issues like deductions for various local taxes. Payroll providers like QuickBooks Payroll and Paychex offer robust services with features to handle multi-state payroll processing, allowing you to process payroll without worrying about compliance issues in different regions.

If your business is relatively small, with fewer employees and fewer states involved, services like Patriot Payroll or OnPay can meet your needs without unnecessary complexity or costs. Understanding your business’s payroll structure will help you narrow down the options.

2. Look for Integration with Other Software

Integrating payroll with other essential business software can streamline operations and save you significant time. Many small businesses use accounting or HR software alongside payroll to track expenses, manage employee benefits, and stay on top of tax obligations. When choosing a payroll provider, make sure it integrates seamlessly with the software your business already uses.

For example, QuickBooks Payroll is particularly beneficial for businesses already using QuickBooks Online for accounting, as the integration allows for automatic syncing of financial data. Similarly, OnPay integrates with a variety of accounting platforms like Xero and QuickBooks, making it a versatile choice for businesses with existing accounting software. Streamlining these processes allows you to reduce errors, avoid redundant data entry, and keep financial information in sync.

When evaluating integration options, also consider other software integrations, such as HR tools, time tracking, and benefits management. A fully integrated payroll service can simplify your administrative tasks and provide a more cohesive workflow for your team.

Here’s a breakdown of which integrations are offered by the providers on our list:

|

Payroll Software |

Accounting |

Time Tracking |

Point of Sale |

|---|---|---|---|

|

Gusto |

✔️ |

✔️ |

❌ |

|

QuickBooks |

✔️ |

✔️ |

❌ |

|

Paychex |

✔️ |

✔️ |

✔️ |

|

Patriot Payroll |

✔️ |

❌ |

❌ |

|

OnPay |

✔️ |

✔️ |

❌ |

3. Understand Pricing and Service Levels

The cost of payroll services is an important consideration for any small business. While some payroll providers offer flat-rate pricing, others charge based on the number of employees or offer tiered pricing depending on the features you need. It’s essential to ensure the pricing structure aligns with your budget and business needs.

Patriot Payroll, for example, offers a very affordable base plan, making it an excellent choice for small businesses with basic payroll needs. However, if you require more advanced features like tax filing, employee benefits management, or HR services, you may need to look at higher-tier plans from providers like Paychex or Gusto. These platforms offer comprehensive payroll services that extend beyond just processing payroll, such as providing HR tools, health benefits management, and compliance assistance.

Make sure to compare the cost of each payroll provider with the services included to ensure you are getting the best value for your business. Additionally, look for services that offer scalability so that as your business grows, you can upgrade your plan without needing to switch providers.

4. Evaluate Automation and Time-Saving Features

The more automated your payroll process is, the less time you’ll spend on administrative tasks. Automated payroll can help ensure that employees are paid on time, every time, and that tax calculations and filings are completed accurately. Payroll providers like QuickBooks Payroll and OnPay offer features like automated tax calculations, payroll tax filing, and direct deposit, which can significantly reduce the time you spend managing payroll and tax-related tasks.

Additionally, features like automated time tracking and employee self-service portals can further streamline the payroll process. Employees can access their pay stubs, submit time off requests, and even update their tax documents through self-service portals. This not only improves accuracy but also empowers your employees to manage their information independently.

Look for providers that offer unlimited payroll runs and the ability to schedule recurring payrolls. These features can save you time and ensure that payroll runs smoothly without requiring constant attention.

5. Customer Support and Service Reliability

While payroll services can automate many tasks, you’ll still need reliable customer support when issues arise. Payroll can be complex, especially during tax season or when dealing with compliance issues, so you need a payroll provider that offers responsive support.

Paychex and Gusto are known for their excellent customer service, offering live support options through phone, chat, or email. It’s important to test the responsiveness of customer support by reviewing customer testimonials or reaching out with questions during your evaluation process. OnPay, for instance, is known for offering personalized support, which can be a huge benefit if you have specific payroll or HR-related questions. In addition to payroll features, some businesses may benefit from tools that optimize operational logistics. For companies managing deliveries or field services, selecting a reliable advanced route planner can significantly enhance efficiency by optimizing travel routes, reducing fuel costs, and improving customer satisfaction.

Make sure the payroll provider you choose offers adequate customer support hours, especially during payroll deadlines, tax filing seasons, or after business hours when issues can arise.

Here’s a breakdown of customer support availability for the payroll software providers on our list:

|

Payroll Software |

24/7 Support |

Phone Support |

|---|---|---|

|

Gusto |

✔️ |

✔️ |

|

QuickBooks Payroll |

✔️ |

✔️ |

|

Paychex |

✔️ |

✔️ |

|

Patriot Payroll |

✔️ |

✔️ |

|

OnPay |

✔️ |

✔️ |

6. Read Reviews and Test the Service

Before committing to a payroll provider, take time to read user reviews from other small business owners to gain insight into the provider’s reliability, customer service, and overall satisfaction. Reviews on platforms like Capterra or Trustpilot can give you a clear picture of what to expect.

In addition, most payroll providers offer free trials or demos of their service. Take advantage of these trials to test the platform’s ease of use, functionality, and customer support before making a long-term commitment. Testing the platform allows you to ensure it meets your expectations and that your team can adapt to the system with ease.

7. Consider Future Growth and Expansion

Finally, it’s important to select a payroll service that can scale with your business. As your business grows, you may hire more employees, expand into new states, or take on additional responsibilities, such as offering benefits to employees. Choose a payroll service that can handle growth and offers the flexibility to add new features as needed.

Providers like Paychex offer scalable solutions with tools to manage payroll, benefits, and HR services for businesses of all sizes, while Gusto offers additional HR and compliance tools that can grow with your business. Choose a provider that will grow with your business journey and adapt to your changing needs.

🏆 Verdict: The Best Payroll Service for Small Businesses

Gusto takes the crown as the best payroll system for small businesses. Its intuitive platform, comprehensive features like automated payroll, tax filings, and benefits management, and seamless integrations with accounting tools make it a standout choice. Gusto also excels in ease of use, offering an accessible experience for businesses of all sizes. The combination of robust functionality and exceptional user support makes it the ultimate payroll solution for streamlining processes and avoiding costly mistakes.

Final Thoughts on Choosing the Best Payroll System for Small Businesses

Selecting the right payroll software is crucial for managing small business payroll effectively. The best payroll systems for small businesses are designed to simplify payroll processing, making it easier to handle payroll taxes, run payroll, and file payroll taxes on time. Payroll software solutions like Gusto, QuickBooks Payroll, Paychex, Patriot Payroll, and OnPay offer different advantages, from ease of use to scalability and affordability. Some are better suited for businesses that need advanced HR features, while others are ideal for those looking for simplicity and low cost. In addition to payroll solutions, small businesses can also benefit greatly from integrating delivery management software into their operations. Efficient delivery management tools help streamline order processing, optimize delivery routes, and improve customer satisfaction by ensuring timely and accurate deliveries. If you are interested in enhancing your business logistics alongside payroll management, exploring the features and benefits of advanced delivery management software solutions could offer valuable insights and operational improvements.

Ultimately, the right payroll provider depends on your business’s specific needs. Whether you want an all-in-one payroll solution, automated tax filing, or a platform that integrates with other business tools, there’s a payroll service that can help streamline your processes. By using a comprehensive payroll system, small business owners can ensure accurate payroll processing, avoid costly mistakes, and save valuable time on administrative tasks. As your business grows, choosing the right payroll system can help you scale efficiently, stay compliant, and improve overall business operations.