Every day, $4.2 trillion moves through digital payment platforms worldwide. Yet most small business owners still pick payment gateways like they’re choosing what to eat for lunch.

That’s a $4.2 trillion mistake.

In 2025, your payment gateway isn’t just a tool – it’s the bridge between your business and profit. Get it wrong, and you’ll lose customers before they click “buy.” Get it right, and you’ll watch your revenue grow as you sell online and cater to international payments and local currencies alike.

Here’s what most experts won’t tell you: The biggest payment platforms aren’t always the best choice for your ecommerce store. With so many payment gateways available, it’s easy to get overwhelmed, but it’s crucial to understand what really matters.

This guide breaks down the three most critical factors in choosing the best payment gateway in 2025. Not the obvious stuff you’ll find in every other article. Instead, you’ll learn:

Why the cheapest option often costs you more, especially when considering setup fees, transaction fees, and monthly fees that can eat into your margins.

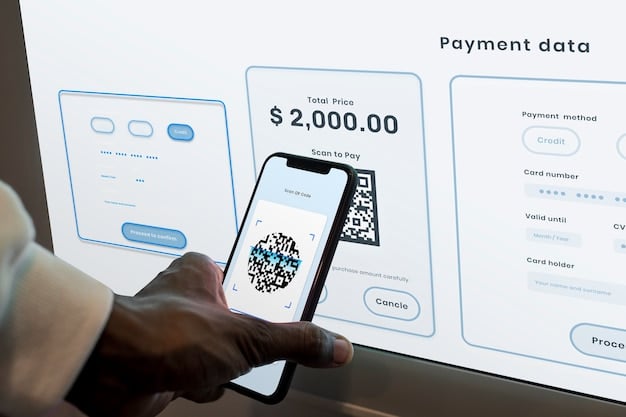

Which security features actually matter (and which are just marketing)? When you’re dealing with sensitive payment information, such as credit card transactions, payment data, and billing addresses, protecting customer data should be your top priority. Card network routes and financial institutions play a key role in keeping your customer’s issuing bank and customer bank secure.

How to future-proof your choice for the next 5 years, ensuring your payment gateway integrates with future payment types like Apple Pay, Google Pay, and a white label payment gateway if you need more control over your brand’s checkout experience.

When selecting your payment gateway, look for one that supports multiple currencies and currency conversions, especially if you plan to scale globally. As you expand, it’s essential to ensure you can accept local payment methods and work seamlessly across major credit cards and card networks.

What does this mean for your business? It means a smooth checkout experience for your customers, boosting customer trust and giving you a competitive edge. A good payment gateway allows for payment off-site and securely handles in-person payments, on-site payments, and even payments through a customer’s browser. Consider incorporating strategies such as **automating payments through recurring billing** to streamline operations and enhance cash flow. This can significantly reduce the manual overhead involved in managing subscriptions and payments. By adopting this method, you can focus more on growth and less on administrative tasks. For more insights on how recurring billing can elevate your business strategy, check out this article on automating payments and increasing revenue.

If you’re running an ecommerce store, it’s important to ensure that the payment gateway can seamlessly integrate with your ecommerce platform to enable global expansion and scale to meet your business demands. Your customers will appreciate an intuitive payment flow, and in return, you’ll have more loyal buyers who can easily pay in their preferred local currencies.

The next 10 minutes of reading will save you months of headaches and thousands in potential losses. Let’s examine what really matters in payment gateway selection – starting with the features that can make or break your business. Remember, not all payment gateways work the same way, and the one you choose should grow with your needs, from credit card transactions to third-party service integrations.

Make the right choice, and you’ll have the infrastructure to thrive, expand, and gain the trust of customers all over the world.

Metrobi drivers are rated 4.97/5

Trusted by local businesses for:

- Background-checked professionals

- Specialized in business deliveries

- Same drivers for consistency

- 4.97/5 average delivery rating

1. Essential Factors to Consider in Payment Gateways

Understand key features for business needs.

Secure transactions with reliable security.

Seamless integration with current systems.

1.1. Feature Set Considerations for Optimal Functionality

The last year saw businesses pushing for more efficient payment gateways. Important features include handling both one-time and recurring transactions. This flexibility allows companies to cater to varied customer needs. Businesses have been asking questions like, what are the primary methods of payment? In 2024, credit/debit cards, bank transfers, and digital wallets surfaced as key methods. These methods reflect how consumers interact with payment systems.

Multi-currency support came to the forefront as businesses expanded globally. More companies wanted gateways that could handle different currencies seamlessly. But beyond just multi-currency, mobile payment options became crucial. With smartphones cementing their place as everyday tools, people expected to pay securely with them. Companies should weigh these features against their specific goals. This offers a custom fit for their growth and customer satisfaction.

Growth in Cross-Border Payments: By 2025, it is estimated that there will be a 42% acceleration in cross-border and cross-currency instant payments due to regulatory changes and technological advancements.

As of 2025, not adopting advanced payment features might hinder business growth. Companies hesitant to enhance payment features may lag. Moving forward, businesses would gain from adopting comprehensive transaction handling, multi-currency support, and mobile options. This move ensures they remain competitive.

1.2. Security Measures for Safe Transactions and Payment Processing

The rise in online payments highlighted security more than ever. Over the past year, ensuring secure transactions was non-negotiable. A standout aspect here was PCI compliance, which reassures customers that their information is handled safely. The confidence PCI brings increases trust and, subsequently, customer loyalty.

Online Payment Acceptance Rates: While in-store payment acceptance rates are around 99%, online acceptance rates hover closer to 90%, suggesting room for improvement in optimizing online payment processes.a

Encryption became a focal point, serving as the defense line against unauthorized access. Encryption turned sensitive data into unreadable formats during transmission. The use of advanced algorithms like AES became common. This approach made sure that data remained secure from end to end. Tokenization, a process of swapping sensitive data with unique identifiers, also proved vital in reducing risk.

Fraud protection has advanced with two-factor authentication becoming standard, as threats grow more sophisticated. Businesses must stay proactive by adapting encryption methods, ensuring PCI compliance, and integrating enhanced fraud prevention tools. A key example is chargeback management software, which automates dispute processes, reduces manual workload, and strengthens security by enabling quicker responses to fraud incidents.

1.3. Integration Ease and Support

Another critical factor is how easily a payment gateway can be integrated. In 2024, many businesses highlighted the importance of seamless integration to current systems. Ensuring gateways are compatible with various platforms was a priority. It minimized disruption and allowed for smoother operations. Compatibility meant fewer issues during implementation, saving time and resources.

The level of technical support offered by gateway providers gained attention. Businesses demanded swift, helpful support to solve issues quickly. Service responsiveness differentiated providers, with some establishing dedicated teams to support integration. Any chosen gateway should offer substantial technical support. Some platforms, known for poor assistance, fell out of favor for this reason.

In 2025, greater emphasis will likely be placed on integration and support. It’s imperative to select gateways with flexible integration options. Continuing evolution in technology indicates that laying the groundwork for seamless integration could prevent costly disruptions. Businesses should also review the technical support offerings of providers, ensuring they choose those best equipped to support their journey.

2. Recent Insights into Alternative Payment Methods: Payment Gateway Trends

Growing acceptance of contactless payments globally.

AI advances in fraud detection for safer transactions.

Open banking reshaping payment gateway landscapes.

2.1. Rise of Contactless and Mobile Payment Options

Cash in Decline: Cash usage globally is anticipated to decline by 40% as consumers increasingly adopt alternative payment methods.

Contactless payments have gained wide acceptance recently, driven by shifts in consumer behavior. Last year, contactless usage surged globally. This growing trend means businesses might need to adjust and incorporate contactless methods into their payment systems to cater to consumer preferences.

Contactless Payment Adoption: 79% of respondents worldwide reported using contactless payments per a survey conducted by MasterCard.

Implementing these payment options brings certain benefits. They offer convenience and speed in processing transactions. But they also present challenges. Security remains a concern, and integration can be complex. Businesses may face hurdles in upgrading systems to support this type of payment.

Looking ahead, with 125 million expected users in the U.S. for mobile payments and 4.4 billion digital wallet users globally by 2025, businesses should consider how to capture this audience. Strategies might include updating point-of-sale (POS) systems and ensuring secure, easy-to-use interfaces.

2.2. Growth of AI and Machine Learning in Fraud Detection

AI and machine learning have played a pivotal role in enhancing fraud detection in payment gateways over the last year. Advanced systems are now capable of real-time analysis of transactions. They identify unusual patterns quickly, improving security measures for businesses. AI is expected to save $10.4 billion annually in fraud prevention by 2025, according to Juniper Research. The data empowers businesses to defend against increasingly sophisticated fraudulent activities.

Case studies show that companies implementing AI have seen reductions in fraud incidents. For example, certain financial firms using AI reported significant declines in false-positive rates, enhancing customer satisfaction and trust. These tools not only help in monitoring transactions but also in maintaining a seamless customer experience.

However, the integration of AI requires investment in technology and skills acquisition for staff. It is important for businesses to balance between justifiable costs and security enhancement benefits. To capitalize on these innovations, companies should prioritize vendor partnerships and invest in AI-driven security measures. They would do well to regularly assess and update these systems to keep pace with evolving threats.

2.3. Open Banking Movement’s Influence on Payment Processors

The open banking movement has continued to reshape the payment gateway landscape significantly. Open banking policies promote transparency and involve third-party developers in creating new financial solutions. This has led to a shift in how payment services are designed and delivered. It has increased innovation and competition among payment gateway providers.

Opportunities from this movement are vast. Businesses have started leveraging open APIs to offer personalized and integrated payment solutions. They gain access to comprehensive consumer data, which helps tailor services to user needs. For instance, firms adopting open banking can streamline operations and provide custom products that meet specific client requirements.

Despite these advantages, open banking also presents risks. Data privacy and security become crucial as more third parties access sensitive information. Businesses must ensure they comply with stringent regulations to protect user data. That’s why being transparent about data use and implementing robust security protocols are steps businesses need to take in this era of open banking.

As this trend develops, companies should look at forming partnerships with fintechs and other financial organizations to build innovative services. It is crucial to stay agile and adaptive to these changes. This way, businesses will position themselves strategically to leverage the potential benefits while minimizing risks.

3. Future-Proofing Your Payment Solutions in 2025

Stay ahead: Embrace new trends in payment gateways.

Stay compliant: Prepare for changing regulations.

Stay connected: Enhance customer experience through better data use.

3.1. Trends Shaping the Future of Payment Gateways

Payment gateways in 2025 are expected to undergo significant transformation. Technologies like blockchain are on the rise. This shift indicates a strong movement toward decentralized finance.

Projected Growth of Stablecoin: Stablecoins, for example, are projected to settle $300 billion daily by year-end 2025.

Payment gateways are also heavily influenced by user experience advancements. Consumers now demand seamless interactions. This drives businesses to adopt more intuitive and responsive platforms. Biometric payments and mobile-first solutions could redefine user interactions, making payments quicker and more secure.

Creating platforms that are not only technologically advanced but also consumer-friendly is vital. As businesses navigate these changes, integrating APIs and fostering innovation will ensure they remain competitive and attractive to customers.

3.2. Adjusting for Regulatory Changes and Compliance

With the rise in digital transactions, payment gateways will encounter heavier regulatory scrutiny. Changes to data privacy laws, like those outlined in recent GDPR amendments, are anticipated. Businesses must adapt proactively to these requirements.

Regulators push towards more secure transaction environments. Businesses should prepare for rigorous checks on data handling practices. More robust fraud protection, encryption, and consumer data management will become mandatory. Failure to comply could lead to substantial penalties.

To navigate this landscape, organizations can build or expand compliance teams. Regular audits and staying informed about new regulations will mitigate risks associated with non-compliance. Investing in compliance technology ensures that businesses not only meet but exceed these standards.

3.3. Enhancing Customer Experience and Retention

User experience remains paramount. In 2025, a payment gateway’s appeal hinges on its interface. Customers demand intuitive, rapid payment processes. Engaging interfaces, easy navigation, and minimal friction enhance satisfaction and loyalty.

Demand for Real-Time Payments: The Forrester study revealed that 80% of respondents believe their customers expect cross-border payments to be processed in near real-time, indicating a shift towards higher customer expectations for payment speed and efficiency.

Feedback loops are crucial for improvement. Gathering user feedback, analyzing it, and swiftly implementing changes can set businesses apart. It demonstrates a commitment to customer needs. Invisible innovations, like AI-driven personalization, can further enrich the user journey.

Case studies highlight that businesses focusing on customer-centric strategies see a noticeable uptick in retention rates. Simple changes, like a smoother checkout process or personalized offers, can yield significant customer loyalty.

Technical Failures: Forrester's data indicates that over 10% of U.S. online adults encountered technical failures at the checkout point in 2023.

3.4. Leveraging Analytics and Data Insights

Understanding customer behavior is key to future-proofing payment solutions. Advanced analytics offer insights into spending patterns. These data-driven insights help tailor marketing strategies and product offerings, maximizing engagement and profits.

By analyzing transaction data, businesses can identify preferences, such as favored payment methods or purchasing frequency. Aligning products and services with consumer behavior ensures high conversion rates.

Cloud-based SaaS solutions are also invaluable. They offer scalable analytics capabilities. From data visualization to predictive analytics, these tools enhance decisions, optimize operations, and increase competitiveness in dynamic markets.

Readers can expand their expertise with these resources, ensuring a profound grasp of how to future-proof payment solutions in 2025.

Conclusion

The shift to digital payments has made choosing the right payment gateway a critical business decision. Our analysis of security, integration, and future trends highlights key factors that shape success in 2025’s payment landscape.

Security remains non-negotiable. PCI compliance and AI-powered fraud detection are essential elements. But security alone isn’t enough – the payment gateway must fit your business operations through seamless integration with your existing merchant account and reliable support. It should also be able to process recurring payments and manage authorization requests effectively.

The merchant-acquiring bank that partners with your global payment gateway plays a significant role in how well you can accept payments across regions. Local payment methods, as well as traditional credit or debit card options, should be integrated to ensure that customers worldwide can make purchases easily.

The payment gateway you choose should be able to process payments swiftly and securely while maintaining robust measures for safeguarding payment details. With the increasing demand for recurring payments, ensuring that your system can process recurring payments efficiently will be crucial.

The payment industry keeps changing. Mobile payments are growing, open banking creates new opportunities, and AI makes transactions safer. Your chosen payment gateway should handle these changes while staying current with regulations.

Think beyond basic features. Look at how the gateway uses data analytics to help your business grow. Consider how it improves customer experience through smooth checkout flows and support for multiple payment methods, ensuring that you can accept payments most conveniently for your customers.

Before making your final choice, ask: Does this payment gateway meet my current needs? Can it grow with my business? Will it keep my customers’ data safe? Does it offer the analysis tools I need?

The right payment gateway does more than just process payments – it becomes a strategic asset for your business growth. Take time to evaluate your options based on these critical factors. Your business success in 2025 may depend on it.