Crowdfunding has become an increasingly popular way for businesses and individuals to raise money, thanks to the power of online fundraising platforms. Whether you’re running a crowdfunding campaign for a creative project or personal fundraising, selecting the right crowdfunding platform is crucial for achieving your goals. By leveraging crowdfunding websites, businesses and individuals can tap into a broader network of donors and backers, ultimately increasing their chances of raising the funds needed. From recurring donations and event registration to virtual events, these top crowdfunding sites offer flexible fee structures and payment processing options, making it easier to accept payments and fundraise effectively.

Metrobi drivers are rated 4.97/5

Trusted by local businesses for:

- Background-checked professionals

- Specialized in business deliveries

- Same drivers for consistency

- 4.97/5 average delivery rating

What is Crowdfunding?

Crowdfunding is a modern method of raising funds by pooling small contributions from a large number of individuals, typically via online crowdfunding platforms. It is an accessible way for entrepreneurs, creatives, nonprofits, and businesses to raise capital for their projects, products, or services. Instead of relying on traditional funding methods such as venture capital firms, loans, or personal savings, crowdfunding allows individuals to directly invest in or donate to projects they believe in. These fundraising websites host crowdfunding campaigns where creators, startups, or nonprofits can present their ideas to potential supporters, offering various incentives or rewards in return for their contributions.

Whether you’re raising funds for a creative project, new business, or personal fundraising effort, crowdfunding offers a flexible funding model that enables you to connect with a global audience. The success of a crowdfunding campaign depends largely on the project’s appeal, marketing efforts, and the potential for future returns, especially for equity-based crowdfunding platforms that cater to accredited investors.

How Does a Crowdfunding Campaign Work?

Crowdfunding campaigns operate by leveraging an online fundraising platform to collect donations or investments from a broad group of people, often referred to as “backers” or “investors.” These platforms allow users to launch a fundraising page showcasing their project or business idea. Depending on the platform, backers can choose to contribute via one-time donations, recurring donations, or by investing in equity or rewards-based models.

Once a crowdfunding campaign is launched, the project creator’s marketing efforts become vital for gaining momentum. By sharing the campaign on social media, leveraging email lists, or using paid advertising, businesses and creators can drive traffic to their donation page. Backers are often incentivized by rewards, exclusive access, or the potential for financial returns (in the case of equity crowdfunding). The goal of the campaign is to reach the fundraising goal before the campaign ends, with some platforms offering flexible funding models that allow creators to keep funds raised even if the goal isn’t met. To enhance your crowdfunding efforts, it’s beneficial to consider your broader strategic partnerships. Finding the right B2B partner can significantly elevate your campaign’s visibility and support. For insights on fostering smarter collaborations, check out this guide on how to select the best B2B partnerships for your initiatives.

Our Best Picks: 10 Best Crowdfunding Sites for Your Business

Best for seed to Series A+ funding: StartEngine

Best for real estate investments: CrowdStreet

Best for early-revenue startups: MicroVentures

Best for reward/equity small business funding: Fundable

Best for all-or-nothing creative projects: Kickstarter

Best for flexible tech funding: Indiegogo

Best for UK grant matching: Crowdfunder UK

Best for startup, real estate & crypto funding: Republic

Best for personal/charitable causes: GoFundMe

Best for high-growth startups: SeedInvest

1. StartEngine

Best for businesses looking to raise funds from seed to Series A+

StartEngine is a top crowdfunding platform that enables companies to raise capital from a broad audience, including both accredited and non-accredited investors. Unlike traditional fundraising methods, StartEngine provides an equity crowdfunding site that supports early-stage businesses through Series A+ rounds. Over 51% of companies return for subsequent fundraising efforts, demonstrating the platform’s effectiveness in long-term capital raising.

By utilizing StartEngine, startups and small businesses can showcase their vision, pitch their business model, and attract investors without relying solely on venture capital firms. The platform also offers additional marketing tools to help businesses optimize their fundraising pages and maximize engagement with potential donors. Companies that leverage StartEngine’s platform effectively can collect donations, secure funding, and accelerate growth.

Key Features

Equity crowdfunding for startups and growing businesses

Accepts both accredited and non-accredited investors

Supports multiple rounds of fundraising

Provides marketing support to boost campaign visibility

Suitable for businesses from seed stage to Series A+

Pros | Cons |

|---|---|

✔️ Supports both early-stage and growing businesses | ❌ Charges a flat fee in addition to success fees |

✔️ High investor engagement and return rate | ❌ Requires extensive compliance and legal documentation |

✔️ Provides marketing tools to enhance fundraising efforts | ❌ Equity fee adds to the overall cost |

Pricing and Fees

Processing Fee: Generally 3.5% of the investment amount, capped at $700 for large investments.

Wire Transfer Fees: Additional fees may be charged by your bank for the transfer of funds.

2. CrowdStreet

Best for real estate investment crowdfunding with accredited investors

CrowdStreet is a top crowdfunding platform specializing in real estate investment opportunities. Designed for accredited investors, it allows individuals to invest in commercial real estate projects, from multifamily developments to office spaces. The platform focuses on offering high-quality, vetted investment opportunities in real estate, providing a chance to participate in projects that were once accessible only to institutional investors or venture capital firms.

What makes CrowdStreet stand out is its rigorous vetting process, which ensures that only projects with high potential for success are listed on the site. This gives investors confidence in the quality of opportunities available. For businesses, CrowdStreet serves as a powerful tool to raise capital, particularly for large-scale commercial real estate ventures. It also allows project sponsors to offer exclusive access to certain investment opportunities, providing a way for individuals to diversify their portfolios with high-potential investments.

Key Features

Focus on commercial real estate investment opportunities

Exclusively for accredited investors

High-quality, vetted real estate projects

Ability to invest in a variety of real estate asset classes

Offers exclusive access to high-potential investment opportunities

Pros | Cons |

|---|---|

✔️ Provides access to high-quality real estate investments | ❌ Exclusively for accredited investors |

✔️ Offers diversified real estate asset classes | ❌ Investment opportunities may require large capital |

✔️ Rigorous vetting process for investor confidence | ❌ Relatively high minimum investment amounts |

✔️ Potential for significant returns in real estate | ❌ Limited to commercial real estate investments |

Pricing and Fees

Set up fee: None

Success fee: Varies by project (negotiated with sponsors)

Transaction fee: Varies depending on the investment

3. MicroVentures

Best for startups with early revenue or traction seeking equity crowdfunding

MicroVentures offers an equity-based crowdfunding platform tailored for startups that have already gained some early revenue or traction in their respective markets. This platform facilitates fundraising campaigns by connecting startups with accredited investors looking to invest in promising ventures. With a focus on early-stage companies, MicroVentures provides a supportive environment for businesses looking to scale their operations and attract additional capital.

MicroVentures emphasizes a collaborative approach between investors and startups, ensuring that both parties benefit from successful fundraising campaigns. Startups can leverage MicroVentures’ network to expand their investor base and gain access to valuable resources for growth. By participating in equity crowdfunding on MicroVentures, startups can secure funding while maintaining control over their business decisions and future growth strategies.

Key Features

Equity-based crowdfunding for startups with early revenue or traction

Collaboration between startups and accredited investors

Support for early-stage companies looking to scale

Access to resources and networking opportunities

Pros | Cons |

|---|---|

✔️ Access to a network of accredited investors | ❌ Requires sharing equity with investors |

✔️ Supportive environment for early-stage startups | ❌ Success fee involves a percentage of funds raised |

✔️ Facilitates collaboration between investors and startups | ❌ Selective in accepting startups |

✔️ Helps startups maintain control over business decisions | ❌ Fees can be relatively high for early-stage fundraising |

Pricing and Fees

Placement Fee: 5% of the investment, paid at closing.

Management Fee: 0.50% annually, with two years upfront.

Carried Interest: 10% of profit after the initial capital is returned.

Offering Costs: 1.5% of the investment, paid at closing.

4. Fundable

Best for small businesses looking for a reward or equity-based crowdfunding platform

Fundable is a versatile crowdfunding platform that offers both reward-based and equity-based models, making it ideal for small businesses seeking to raise funds. Known for its no upfront fees, Fundable allows businesses to start their fundraising campaign without financial risk. The platform is designed to support businesses that are ready to raise funds through community-driven campaigns and helps entrepreneurs gain financial support by engaging with a large network of potential investors or backers.

The platform’s flexible funding model offers businesses the chance to raise funds even if they do not meet their fundraising goal, making it an attractive option for those not wanting to rely on the “all or nothing” approach. Fundable also has no upfront fees, although businesses must meet their fundraising goals to unlock the funds raised. This platform is perfect for small businesses aiming to reach their funding objectives with minimal financial pressure and a clear path to launching their project.

Key Features

Reward and equity-based crowdfunding models

No upfront fees, with a focus on meeting fundraising goals

Flexible funding, allowing businesses to keep funds even if goals are unmet

Popular with small businesses seeking to raise funds

Pros | Cons |

|---|---|

✔️ No upfront fees | ❌ Requires meeting fundraising goals to release funds |

✔️ Flexible funding options | ❌ Transaction fees apply to credit card payments |

✔️ Suitable for both reward and equity-based models | ❌ Charges a platform fee of 5% |

✔️ Popular with small businesses | ❌ Limited to small businesses, may not be ideal for larger ventures |

Pricing and Fees

Set up fee: None

Success fee: None

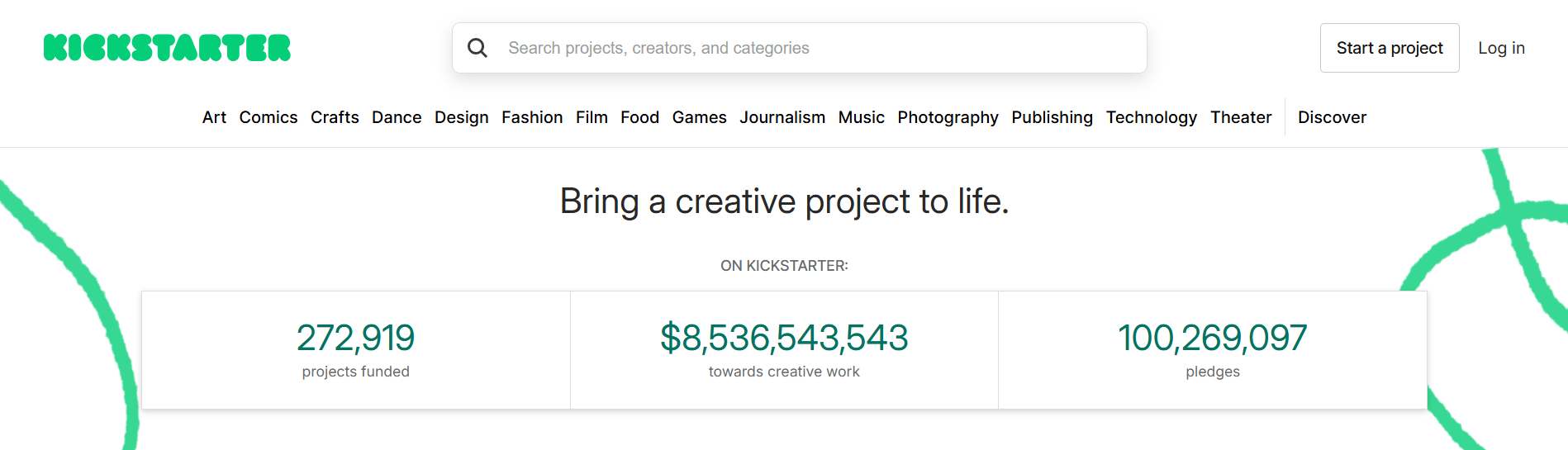

5. Kickstarter

Best for creative projects seeking all-or-nothing funding

Kickstarter is one of the most popular crowdfunding websites, particularly for creative projects such as product launches, art, music, and film. The platform operates under an all-or-nothing funding model, meaning that if the project does not meet its fundraising goal, no money is collected from backers. This structure adds a sense of urgency and ensures that projects only receive funding when they meet their target. Kickstarter is ideal for individuals or businesses with compelling creative ideas looking to bring them to life with the support of their community.

Kickstarter’s focus on creative projects has helped countless entrepreneurs and creators raise substantial funds for new products, innovations, and artistic endeavors. Backers often receive early access or exclusive rewards, making it an attractive proposition for those interested in supporting a project. As a crowdfunding platform, Kickstarter is best suited for those with a clear project goal and the ability to market it effectively to gain momentum and potential backers.

Key Features

All-or-nothing funding model for creative projects

Ideal for product launches and artistic endeavors

Offers pre-order incentives and rewards for backers

Well-known platform with a large, engaged user base

Pros | Cons |

|---|---|

✔️ All-or-nothing model ensures only viable projects get funded | ❌ No funds if the goal is not met |

✔️ Large, engaged community of backers | ❌ Platform fee is charged only if the goal is met |

✔️ Ideal for creative and innovative projects | ❌ Transaction fees apply to payments |

✔️ Offers rewards such as early access and exclusive items | ❌ Limited to specific types of projects (mainly creative) |

Pricing and Fees

Platform fee: 5% (only if the goal is met)

Transaction fee: 3–5% + $0.30 per pledge

6. Indiegogo

Best for tech and innovation projects with flexible funding options

Indiegogo is a popular crowdfunding platform with a strong focus on tech, innovation, and entrepreneurial ventures. Unlike Kickstarter, Indiegogo offers flexible funding options, allowing creators to keep the funds raised even if they do not meet their fundraising goal. This makes it an excellent platform for projects with a high degree of uncertainty or those looking for early-stage financial support without the pressure of meeting a set target. Indiegogo’s platform is particularly known for its backing of technology products and innovative ideas that push the boundaries of conventional thinking.

Indiegogo also provides a wide range of marketing and promotional tools to help boost the visibility of a campaign. This enables businesses to attract more donors, gain momentum, and increase their chances of successfully reaching their fundraising goal. Whether a project is fully funded or partially funded, Indiegogo offers the flexibility to keep the raised funds, which appeals to many entrepreneurs.

Key Features

Flexible funding model: keep funds even if the goal is unmet

Ideal for tech, innovation, and entrepreneurial projects

Offers various promotional tools to enhance campaign visibility

Global reach with a large user base

Pros | Cons |

|---|---|

✔️ Flexible funding allows you to keep funds even if the goal is not met | ❌ Transaction fees apply to each transaction |

✔️ Well-suited for tech and innovation projects | ❌ Platform fees apply regardless of goal met |

✔️ Wide range of marketing tools to boost visibility | ❌ Limited exposure for non-tech creative projects |

✔️ Large international reach with global backers | ❌ Fees can add up quickly with large campaigns |

Pricing and Fees

Platform fee: 5%

Transaction fee: 3% + $0.20 per transaction

7. Crowdfunder UK

Best for UK businesses seeking reward-based crowdfunding with grants

Crowdfunder UK is a leading crowdfunding platform for UK-based businesses, offering a unique blend of reward-based crowdfunding and grant matching. It connects businesses with potential donors and investors, allowing them to raise funds for their campaigns while matching them with available government grants. Crowdfunder UK is particularly well-suited for businesses that are located in the UK and those looking to tap into government funding opportunities alongside public donations.

Crowdfunder UK’s platform makes it easy for businesses to create a fundraising campaign and collect donations. The platform offers a highly supportive environment for UK startups, community projects, and nonprofits. Additionally, businesses can leverage the platform’s tools to maximize engagement, improve their fundraising efforts, and reach their fundraising goals with ease.

Key Features

Reward-based crowdfunding with grant-matching opportunities

Specifically for UK-based businesses

Helps businesses collect donations and raise capital from a local network

Offers comprehensive marketing tools to promote campaigns

Pros | Cons |

|---|---|

✔️ Grant matching opportunities for UK businesses | ❌ Limited to UK-based businesses only |

✔️ Suitable for startups and community projects | ❌ Platform fee and transaction fees can be high |

✔️ Provides marketing tools to improve fundraising efforts | ❌ Grants may require additional application steps |

✔️ Good for both small and large-scale fundraising | ❌ Platform is mainly focused on the UK market |

Pricing and Fees

Platform fee: up to 5% + VAT (for-profit)

Transaction fee: 2.4% + 20p + VAT

8. Republic

Best for startups, real estate, and crypto projects seeking equity crowdfunding

Republic is an equity crowdfunding platform that offers a variety of investment options for startups, real estate projects, and even crypto ventures. The platform allows companies to raise capital from accredited and non-accredited investors alike, making it a great option for businesses at various stages of growth. Republic’s high success rate, with 90% of campaigns meeting their fundraising goals, speaks to its effectiveness in helping businesses raise capital.

Republic provides comprehensive tools to help startups create engaging pitch decks and optimize their fundraising campaigns. The platform’s focus on multiple sectors, including real estate and cryptocurrency, expands its appeal to a wide range of entrepreneurs looking for funding. Whether you’re in the tech, real estate, or crypto space, Republic offers a platform to attract a diverse group of investors.

Key Features

Equity crowdfunding for startups, real estate, and crypto projects

90% success rate for campaigns reaching their fundraising goals

Open to both accredited and non-accredited investors

Comprehensive pitch deck creation tools and marketing support

Pros | Cons |

|---|---|

✔️ Supports startups across various industries | ❌ Exact equity fee percentage varies by campaign |

✔️ High success rate for campaigns reaching their goals | ❌ Platform charges success fees |

✔️ Allows non-accredited investors to participate | ❌ May require extensive legal documentation for certain campaigns |

✔️ Comprehensive marketing and fundraising tools | ❌ Success fees can increase total fundraising costs |

Pricing and Fees

Administrative fee: Varies by campaign (typically 2.5%)

Fundraising range: Average $500K

9. GoFundMe

Best for personal and charitable fundraising with no platform fees

GoFundMe is one of the most widely recognized crowdfunding platforms, especially for personal and charitable causes. Unlike other platforms, GoFundMe does not charge a platform fee, making it a popular choice for individuals raising money for personal needs such as medical expenses, education, or emergency relief. While it is generally used for individual causes, it can also support community fundraising campaigns and charitable efforts.

Backers can donate to campaigns without feeling pressured to receive rewards, as the platform is focused on the altruistic aspect of giving. GoFundMe also integrates with social media and provides personalized tools to increase visibility, making it easy for campaigners to share their efforts and connect with a wider audience.

Key Features

No platform fees and 100% of donations go directly to campaigners

Simple setup for personal and charitable causes

Integration with social media for easy sharing and exposure

A large, diverse user base with a global reach

Pros | Cons |

|---|---|

✔️ No platform fees, 100% of donations go directly to campaigners | ❌ Transaction fees apply (2.9% + $0.30 per donation) |

✔️ Easy to set up for personal, medical, or charitable causes | ❌ Limited to personal and charitable fundraising |

✔️ Large and active community of donors | ❌ May not be suitable for business or product-based campaigns |

✔️ Extensive social media integration for wider reach | ❌ Limited to donations only, without rewards or equity options |

Pricing and Fees

Platform fee: None

Transaction fee: 2.9% + $0.30 per donation

10. Patreon

Best for ongoing, membership-based crowdfunding

Patreon is a crowdfunding platform designed for creators to receive recurring support from their audience. Unlike traditional crowdfunding models, Patreon allows creators to set up membership tiers that backers can subscribe to on a monthly basis. This is ideal for content creators, artists, musicians, writers, and other influencers who rely on consistent funding to support their work.

Patreon also offers exclusive content and perks to subscribers, creating a strong bond between creators and their supporters. With no fundraising deadlines, creators can focus on building a sustainable income stream through their fanbase while continuing to produce the content their audience loves. This model makes Patreon a great fit for creators seeking a long-term revenue source.

Key Features

Recurring, membership-based crowdfunding

Ideal for content creators, artists, and influencers

Offers exclusive content and perks for subscribers

No deadlines, allowing creators to build a sustainable income

Pros | Cons |

|---|---|

✔️ Provides ongoing, sustainable funding for creators | ❌ Platform takes a percentage of creators’ earnings (5%–12%) |

✔️ Direct relationship between creators and supporters | ❌ Requires consistent content creation to maintain backers |

✔️ Offers tiered membership options with rewards | ❌ Difficult for creators to break into a competitive space |

✔️ Exclusive content model fosters community and loyalty | ❌ Platform fees may decrease earnings for smaller creators |

Pricing and Fees

Platform fee: 5%–12%, depending on the plan

Transaction fee: 2.9% + $0.30 per transaction

Our Methodology for Choosing the Best Crowdfunding Platforms

When evaluating crowdfunding platforms, we considered a few key factors to ensure we selected the best options for various fundraising needs. First, we assessed whether the platform was suitable for different types of projects, such as creative ventures, small businesses, or personal causes.

We also paid close attention to each platform’s fee structure, including platform and transaction fees, as these impacted the amount of funds raised. Lower fees were prioritized to ensure more money reached the campaigners.

Reputation and user experience were critical. We focused on platforms with positive reviews and easy-to-use interfaces, which made the process smoother for both campaigners and donors.

Marketing tools were another important factor. We looked for platforms that offered features to increase campaign visibility, such as email integration and social media sharing options. Platforms with a large, engaged audience were favored, as they offered greater potential to raise funds.

Lastly, we considered additional features, such as flexible funding options and recurring donation models, which allowed campaigns to accept payments through systems like PayPal and raise more money over time.

Benefits of Using Crowdfunding for Your Project

Crowdfunding offers several advantages to those looking to raise funds for their projects. Whether you’re a small business owner, a creative entrepreneur, or a nonprofit, crowdfunding can help you collect donations or raise capital from individual investors.

1. Access to a Global Audience

Crowdfunding platforms connect you with a vast pool of potential donors or investors. By hosting your campaign on a popular crowdfunding site, your project can reach thousands of people worldwide who may be interested in supporting your cause, creative project, or business idea.

2. Lower Barrier to Entry

Unlike traditional funding methods, crowdfunding provides a relatively low barrier to entry. Whether you’re a startup in the early stages or a nonprofit looking to raise money, you don’t need to rely on venture capital firms or banks to secure funding. You can easily start an online fundraising campaign and attract small contributions from many people.

3. Flexible Funding Options

Many crowdfunding websites offer flexible funding models. This means that even if you don’t meet your fundraising goal, you can still keep the funds raised and use them to continue working on your project. This flexibility gives you more freedom in managing your fundraising efforts and allows you to plan accordingly.

4. Market Validation and Exposure

Launching a crowdfunding campaign provides an opportunity to test market demand for your product or idea. The support you receive can validate your business concept and demonstrate to potential investors or partners that there is genuine interest in your offering. It’s also a great way to build buzz and gain media attention for your project, helping to further drive marketing efforts.

5. Build a Community of Supporters

Crowdfunding helps foster a sense of community around your project. By connecting directly with your backers or supporters, you can create lasting relationships that extend beyond the fundraising campaign. For small businesses and creative projects, this sense of community can lead to repeat donations, word-of-mouth marketing, and future success.

Frequently Asked Questions (FAQ)

What is crowdfunding?

Crowdfunding is a process where individuals or organizations raise funds by gathering small contributions from a large number of people, typically via online fundraising platforms. It’s often used to support creative projects, startups, or personal causes, allowing anyone with an idea to access the capital they need.

Does crowdfunding work?

Yes, crowdfunding can be very effective for raising funds, especially when the campaign is well-executed. Successful crowdfunding relies on setting a clear fundraising goal, effective marketing efforts, and engaging potential donors or investors. With the right strategy, crowdfunding can be an excellent alternative to traditional funding methods.

Can I use crowdfunding for personal fundraising?

Yes, crowdfunding can be used for personal fundraising. Platforms like GoFundMe allow individuals to raise funds for a variety of personal causes, including medical expenses, emergencies, or educational needs. These platforms offer a user-friendly donation page to collect money from friends, family, and even strangers.

What is an equity crowdfunding platform?

An equity crowdfunding platform is a specialized type of crowdfunding site where businesses offer equity or ownership shares to investors in exchange for funds. This type of fundraising is typically used by startups or companies looking to raise capital from accredited investors or the general public through a crowdfunding campaign.

How do crowdfunding sites charge fees?

Crowdfunding sites generally charge platform fees and transaction fees, which can vary depending on the platform. These fees usually range from 3% to 10%, depending on the funding model (all-or-nothing or flexible funding). Some platforms also charge additional fees for payment processing or subscriptions, so it’s important to check the fee structures before launching a campaign.

Why the Right Crowdfunding Platform Can Help You Raise Money

The key to successful crowdfunding lies in choosing the best crowdfunding platform that fits your specific fundraising goals. Whether you’re seeking recurring donations, sponsor matching, or looking to raise money for your existing business, a well-structured donation page and effective crowdfunding work can drive success. By understanding the various fee structures, processing fees, and unique features like exclusive access and virtual events, you can ensure that your crowdfunding campaign runs smoothly. With tools that allow you to track donor data and accept payments through platforms like PayPal, you’ll be well-equipped to reach your fundraising target and secure all the money you need for your project.